“Mission, then, is not strong people doing big things for God. It is weak people who have been broken open by grace—fully known and fully...

Read More >

Central Florida Episcopalian News & Articles

From sun-swept beaches to sprawling cities, from the Space Coast to rural citrus and cattle country, from cradle Episcopalians to those brand-new to the faith, the Diocese of Central Florida embodies diversity, and we have good news to share. Read about God's work among us as we grow in faith, hope and love.

Featured News

Latest News

2026 Diocesan Convention Address

2/7/26 •

Other Videos

“Mission, then, is not strong people doing big things for God. It is weak people who have been broken open by grace—fully known and fully loved—carrying a treasure that is not theirs, in a strength that is not theirs, for a glory that is not theirs.” In his 2026 Convention...

Read More >

News

Annual UBE Absalom Jones Celebration Set as 'Call for Justice, Healing and Hope'

2/5/26 •

Diocesan Family

The Canon Nelson W. Pinder UBE Chapter will host its annual Absalom Jones Celebration on Feb. 28, 2026, at St. Richard’s in Winter Park, featuring...

Read More >

News

St. Barnabas, DeLand, Rector Carries Out Call to Serve the Vulnerable

1/20/26 •

Diocesan Family

The Rev. Audrey Sutton, rector of St. Barnabas in DeLand and an abuse survivor, has translated her personal passion for safety and justice into a...

Read More >

All News & Content

2026 Diocesan Convention Address

2/7/26 • Other Videos2026 Diocesan Convention Sermon

2/7/26 • Sermon Videos“Diocese of Central Florida, this is who you are: rooted and grounded in love—beloved children of the Father, secured by the Son, strengthened by the...

Read More >Annual UBE Absalom Jones Celebration Set as ‘Call for Justice, Healing and Hope’

2/5/26 • Diocesan FamilyThe Canon Nelson W. Pinder UBE Chapter will host its annual Absalom Jones Celebration on Feb. 28, 2026, at St. Richard’s in Winter Park, featuring...

Read More >Winter Camp at Wingmann Helps Students Discover the Power of Exchange

1/28/26 • Children & YouthOver 60 students from across our diocese recently gathered for Winter Camp 2026! Centered on Philippians 3:7, the “Exchange” theme challenged campers to trade worldly...

Read More >President Paul Kennedy Spends First Year Visiting All Churches in Central Deanery

1/22/26 • Diocesan FamilyPaul Kennedy, president of the Central Deanery, spent his first year in office visiting all 24 churches in his region to personally support and connect...

Read More >St. Barnabas, DeLand, Rector Carries Out Call to Serve the Vulnerable

1/20/26 • Diocesan FamilyThe Rev. Audrey Sutton, rector of St. Barnabas in DeLand and an abuse survivor, has translated her personal passion for safety and justice into a...

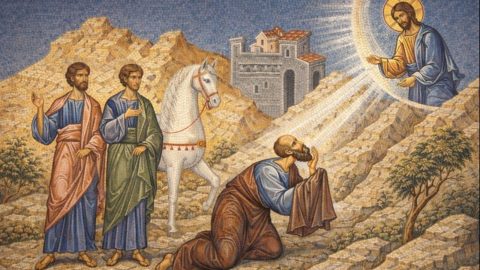

Read More >Our Identity as the Body of Christ

1/19/26 • ChurchCelebrating the conversion of St. Paul provides an opportunity to reflect on his profound teaching regarding our collective identity as the “body of Christ.” This...

Read More >Central Florida Acolyte Retreat Highlights Key Worship Role

1/17/26 • Children & YouthBrently Cuthbertson returned to serving as an acolyte after decades to join his two sons at the Cathedral Church of St. Luke, highlighting the multigenerational...

Read More >‘Swan Song Residency’ at St. Paul’s, London, Celebrates God’s Glory in Music

1/13/26 • Diocesan FamilyAndrew Walker, the longtime director of music at St. Michael’s, Orlando, recently led a 48-member choir in a prestigious residency at St. Paul’s Cathedral in...

Read More >Advent: God Is Bringing Us Hope

12/17/25 • GospelIn this theological reflection on Isaiah 40, Bishop Holcomb explores how the desperation caused by human suffering and sin leads directly to the “good and...

Read More >Okeechobee Congregation Partners With Eagle Riders in Wreaths Across America Event

12/16/25 • Diocesan FamilyThe Rev. Kay Mueller delivered the invocation and benediction at the 10th annual Wreaths Across America Day ceremony in Okeechobee, where over 1,300 wreaths were...

Read More >Holcomb Ordains 10 Transitional Deacons in November Service

12/14/25 • Diocesan FamilyThe Rt. Rev. Dr. Justin S. Holcomb ordained 10 individuals to the transitional diaconate at a special service held at the Cathedral Church of St....

Read More >